Ethereum is, along with Bitcoin and Bitcoin Cash, one of the strongest cryptocurrencies of the moment. Its value at the end of 2019 did not exceed 120 euros. Today its price reaches 260 euros, with a growth in the last two months of more than 100% . The value of Bitcoin, as opposed to Ethereum, managed to climb 58%. It's a fact: Ethereum is the best cryptocurrency to invest in 2020. Find out the reasons below.

Almost 140% in less than two months: this is how Ethereum has grown

Ethereum's bullish value in the last two months has followed the trend set by Bitcoin. In mid-December 2019, the virtual currency reached its minimum annual value, with a price of 109 euros per currency . Just a few weeks later, the value increased again with occasional ups and downs to 209 euros. Currently its value reaches 258 euros , which represents a growth of 140% in less than two months. There is nothing.

Ethereum value in the last year.

All in all, the biggest rise experienced by the currency takes us until January 2018, when its value reached over 1,180 euros. At that time, the figures ranged between 180 and 190 euros. In just half a year, the currency grew by 600% .

This growth could become apparent again from the second half of 2020 for the reasons that we will explain below. For now, some expert voices such as Kain Warwick, one of the founders of the DeFi platform, defend that the future value of the currency is very promising . His statements in a Cointelegraph interview read the following:

"All the projects and applications of interest are emerging around Ethereum, and it is difficult to see how this fact does not drive awareness, and this, in turn, the reassessment of the value proposition of the asset."

If we use some studies like the one that the San José State University published just a few days ago, this argument is further reinforced. The study in question analyzes the trend of Ethereum from December 2017 to December 2018. The conclusion is as follows:

“Ether as a cryptocurrency is a hedge against the markets of the United States Stock Exchange. When the currency markets are affected, it reflects that Ethereum is a diversifier for the US dollar. "

Bitcoin Halving: The Reason Ethereum Will Experience Its Highest Growth In 2020

The trend of Bitcoin guides the rest of the trends in the cryptocurrency market: it is a fact. For this same reason, the value of Ether will experience one of the largest growths in its history, if not the most. Bitcoin Halving is described as a process in which the reward for solving blockchains is divided in half. These rewards are intended for all those users who are dedicated to mining virtual assets, and their value is currently at 12.5 BTC .

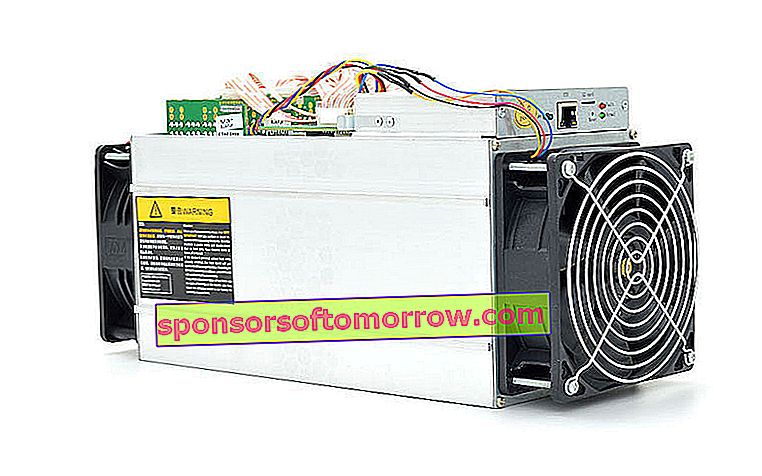

Cryptocurrency mining machine.

If everything goes according to plan, the reward value will be reduced to 6.25 on May 23, the day on which the aforementioned process will take place. At this point, the bullish value of Bitcoin will skyrocket precisely because of its low mining profitability , which will end up influencing ETH to a greater or lesser extent.

This fact becomes even more important if we consider that the currency has doubled the upward trend of the trend followed by Bitcoin in recent months. We refer again to the data thrown at the beginning of the article: 140% in the case of the first and 58% in the case of Bitcoin. Experts say that the latter could reach the barrier of $ 20,000 (about 18,530 euros at the exchange rate), which represents an increase of 200% compared to the current value. If Ethereum doubles this percentage growth, it could grow to 1,040 euros per asset, taking the current value as a reference .

The largest US bank could merge with ConsenSys

On February 11, Reuters dropped the bomb: JPMorgan, the largest bank in the United States, is in talks with ConsenSys to merge its own blockchain with one of the most influential studios on the Ethereum blockchain. In fact, ConsenSys was founded by one of the creators of the virtual currency .

Image taken from Emerj.com.

Quorum, JPMorgan's private blockchain network, used part of the Ether blockchain infrastructure to distribute itself across more than 360 banks. Everything indicates that the merger of both chains will take place during the next six months. If confirmed, everything indicates that the Ethereum chain will receive a strong investment from the main US bank , which will end up having an impact on the final market value and its future commitment.

The number of operations with Ethereum is getting higher

The increase in the value of the virtual asset has been accompanied by an increase in the number of operations with open source cryptocurrency. In the last week alone, the number of active addresses has increased by more than 21%, and the number of transactions by 13%, according to data from Glassnode.

The platform itself confirms what many had been predicting months ago: the value of Ethereum has not stopped rising for seven weeks . This trend has not been repeated since the currency began to experience a rise of almost 600% between the end of 2017 and the beginning of 2018. In fact, it is its best streak since going to the market.

Everything indicates that this streak will continue to be maintained during the last weeks until May of this year, when the Bitcoin Halving is supposed to trigger the value of all cryptos . If the merger with JPMorgan is confirmed, Ethereum could be a headache for Bitcoin, creating a pull effect that would lead to a massive flight of investors towards the creation of Gavin Wood and Jeffrey Wilcke, which would end up increasing the value of even more. Ether.