With the opening of the term to present the Income Statement just around the corner, there are not exactly a few who wonder if they have to declare operations with cryptocurrencies in the draft of the Treasury. The short answer is yes . For three years the Administration has paid special attention to all those who operate with cryptocurrencies. Also on those who are dedicated to mining Bitcoin and other less popular currencies. Depending on the income and the activity that we develop around them, we will have to pay taxes in one or another section of the Declaration. Let's see how and how much.

The data that we will present below are indicative. From tuexperto.com we strongly recommend resorting to a specialized manager to know the taxation of the activities carried out around operations with cryptocurrencies.

I have bought and sold Bitcoin, do I have to declare something?

The truth is that yes. The previous campaign managed by the AEAT (State Tax Administration Agency) defined a series of guidelines that will mark the next campaign that will begin in April. At the moment, the activity is reflected in the section destined to patrimonial variations, and they are taxed as personal income tax (Income Tax on Individuals).

If we refer to the tax rates of the 2018 campaign, the Treasury established a series of amounts in the different sections of personal income tax whose percentage is applied to the net profit obtained through the operation with cryptocurrencies. The sections defined by the Administration are the following:

- 19% for capital gains of up to 6,000 euros.

- 21% for capital gains of up to 50,000 euros

- 23% for capital gains greater than 50,000 euros

These tax rates will have to be applied in the respective section of the Declaration for patrimonial changes. Let's see examples:

- Pedro has earned a total of 13,400 euros by selling his Bitcoin in 2019. Pedro will have to deduct 21% of that amount when entering the second tax rate.

- Marta buys Bitcoin for 4,000 euros and sells them for 25,000 euros. Marta obtains a capital gain of 21,000, so she will have to deduct 21% of that amount, which represents about 4,410 euros.

But what happens if we make no capital gains and lose money on the sale of coins? Since it is an alteration of the patrimony, the loss will have to be also reflected in the mentioned section of the draft. As it is a capital loss, it will not be subject to any tax rate , but will have to be compensated in the following four years.

I have bought Bitcoin but I have not sold anything, do I have to declare it?

Affirmative. Again we are faced with an alteration of the patrimony: the cryptocurrencies are taxed as capital gains or losses . Therefore, any amount that we have invested in the purchase of cryptocurrencies must be reflected in the same section mentioned above.

I have exchanged Bitcoin for another cryptocurrency, does it have to be declared?

Again, the answer is yes. Any transaction that involves an alteration of the patrimony must be declared before the Treasury. Not only will we have to declare the amount invested in the original currency, but we will also have to apply the aforementioned tax rates on the total value of the currency exchange. Let's see examples.

- Juan exchanges Bitcoin for Ethereum and obtains a positive economic return of 400 euros. Juan will have to declare the capital gain by deducting 19% of that amount, since it is below 6,000 euros.

- Maria exchanges Litecoin for Bitcoin and obtains a negative economic return of 9,000 euros. Maria will have to declare the loss as it affects her personal assets.

I am dedicated to Bitcoin mining, what do I have to do?

If part of our activity depends on the mining of virtual currencies, the type of tax that we will have to apply is different from that mentioned in previous cases. The reason? It is not an extraordinary alteration of assets, but rather an activity that generates capital gains .

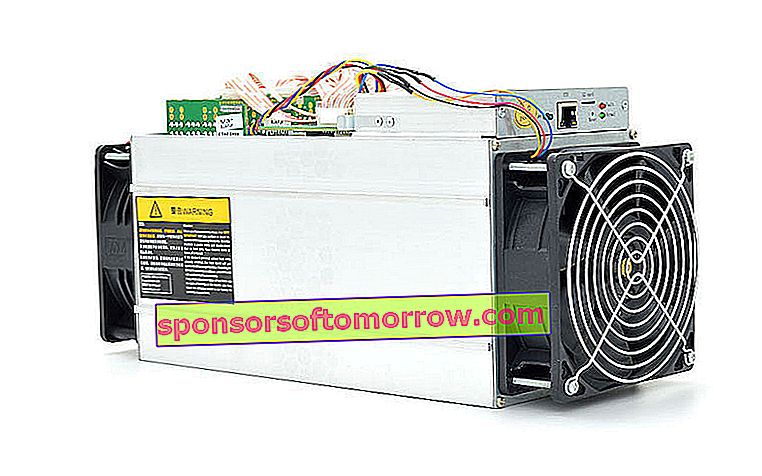

Cryptocurrency mining machine.

Although the Treasury has not yet regularized this economic activity, the Administration obliges to pay what is known as the Economic Activities Tax . Previously, we will have to register as autonomous in the RETA if the conditions for this are met or as a company in the respective models that the Treasury defines for companies. In the latter case we will have to declare the capital gain generated in the Corporation Tax , which generally has a tax rate of 25% on the net profit.

I have a company and I accept payments with Bitcoin, what taxation does it require?

Outside of cryptocurrency mining, it may be the case that a business supports payments via Bitcoin. These payments must not only be reflected in the accounting of the company, but they will have to bear VAT on all those products and services that require it .

Later they will have to be declared in the pertinent section related to the Corporation Tax . Also in the respective quarterly VAT return. There is only one case in which this VAT will not have to be passed on: when cryptocurrencies are purchased through a formal currency , such as euros or dollars. In this case, the party that sells these cryptocurrencies will have to be in charge of making the conversion to euros to later pass it on to the treasury.

What happens if I do not declare the Bitcoin in the Income Declaration?

Last year, Hajando sent a letter in writing to more than 15,000 taxpayers notifying about the obligation to declare the profits obtained from operations with cryptocurrencies. What happens if we decide not to report the income obtained during the fiscal year?

Currently the fines from the Treasury are between 50% and 150% of the amounts that are not declared , amounts that will have to be paid together with the percentage that is applied as a penalty. If we do not send the Declaration on time, the charges for delays range from 5% to 20% , depending on the total time of delay.