Bizum, Google Pay, Samsung Pay, Apple Pay, TWYP, BBVA Wallet ... Currently, there are many options that allow us to pay with our mobile without resorting to credit or debit cards . Each of these options makes use of a different type of technology in which security is prioritized above all else. In fact, everything you need to know about mobile payments goes beyond the applications themselves: security methods, standards, encryption technologies, payments to third parties ... To shed some light on this topic we have created a worksheet route with everything that is convenient to know about this type of system.

12 Bizum Questions and Answers to Send Free Money

What are the technologies used to pay with the mobile?

Before talking about the different types of applications, it is necessary to know the technology behind them. The current ecosystem of applications drinks from three types of technologies: NFC, QR and TLS. Each of these technologies is oriented to a different scenario. For example, NFC, also known as Near Field Communication , is intended to be used in POS devices (dataphones, in popular language) such as those we can find in any consumer store . As it is a technology that depends on a specific chip, not all mobile devices are compatible with payment through NFC.

NFC technology is also common in smart watches and bracelets. The integration of this technology in wearables allows us to get rid of the phone to not depend on the device.

NFC compatibility also depends on the application we use. Today, there are banks that do not support payment through NFC , so we are forced to resort to third-party solutions, such as Apple Pay or Google Pay. To pay through this system, just hold the phone close to the dataphone with the corresponding application open and the NFC active to complete the transition. Depending on the amount, the application will ask us to enter a password or the fingerprint that we have previously registered.

It is time to talk about QR technology, also known as Quick Response. QR codes are an evolution of the traditional barcode. Due to the current health situation, its use has spread in bars and restaurants to avoid human contact. Unfortunately, the use of this technology in mobile payment applications is not yet very popular in our country . Yes, it is in Japan or China, where payments are made through applications like WeChat.

Applications such as PayPal allow us to transfer money between accounts through a QR code. There is talk that WhatsApp will launch a similar method throughout 2021.

If we focus strictly on its operation, the system does not differ much from NFC technology. The biggest difference with respect to the latter is that it does not depend on a dedicated chip, since the identification of the code is carried out through the mobile camera . To this must be added that security between transactions depends on the application itself rather than on the system itself. In other words, the creators of the application are responsible for the security of payments using QR codes.

The latest standard used in mobile payments is the TLS ( Transport Layer Security in English) standard. This technology is in charge of encrypting conventional transactions between banks : transfers, service payments ... It is also the technology used in Bizum and TWYP, two of the most popular payment options in our country.

What is the difference between banking apps and third-party apps?

Within the current application park we can divide the options between bank applications and third-party applications. The difference between these two groups in purely practical terms stem from the philosophy of each application itself. And it is that while bank applications are intended to carry out any type of transaction from a registered bank account (issuance of credit cards, transfers to other entities, request for bank loans, payment of fees and services, checking bank movements, debit card cancellation), third-party solutions are limited to offering mobile payments via a credit or debit card.

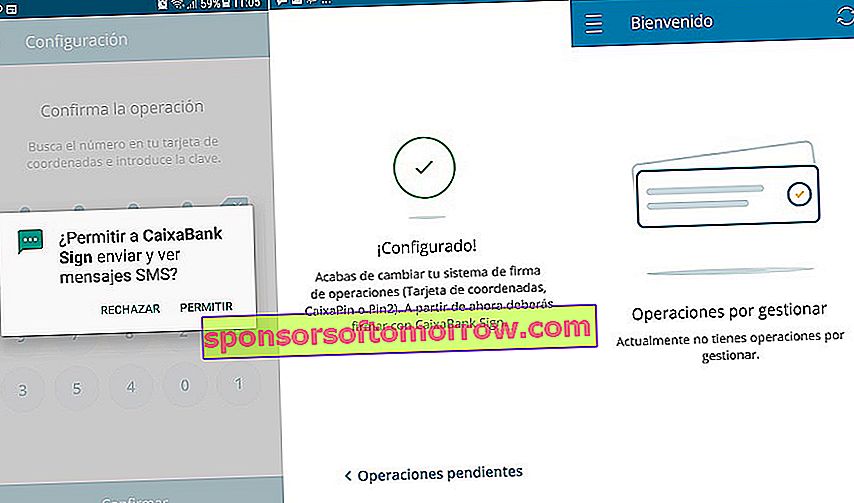

This is what the CaixaBank application looks like.

On a strictly functional level, third-party applications serve as a complement to bank applications in case they lack support via NFC . Within the first group we can find applications such as ImaginBank, La Caixa, BBVA, Banco Santander or ING. In the second group we find applications such as Google Pay, Apple Pay or Samsung Pay.

Is mobile payment safe? Can they hack me? Is it more secure than a conventional card?

At this point, the most logical thing to do is wonder about the security of this type of system. As curious as it may seem, the security methods used in mobile payments are the same as those used in credit and debit cards and conventional transactions. In fact, most cards today have an NFC chip that allows them to make contactless payments , the same NFC chip that we can find on our phones.

The use of this technology not only helps to improve the user experience, it is also intended to prevent possible attempts to steal cards through the duplication or replication of credentials , since we will not have to insert a physical card in the dataphone. Something similar happens with the bank's own applications if we focus on transactions. By making use of the same security systems used in conventional operations, any type of transaction carried out through the application is protected by the same algorithms that support bank security.

5 best apps to share expenses with friends

As for the possibility of suffering a 'hack', the majority of cases that are reported today are due to social engineering methods . These methods are used to make the user believe that he is inside a page, application or service that does not correspond to the real support. Theft attempts are often made through e-mails, impersonating banks. It is also common to use Bizum in scams forged around applications such as Vibbo, Milanuncios or Wallapop. None of these cases has to do with the security of the applications.

All the differences between Bizum, Google Pay, Samsung Pay, Apple Pay, TWYP and BBVA Wallet

We have already discussed the differences between systems. Now it's time to talk about the differences between the applications that currently coexist on Android and iOS, starting with Bizum.

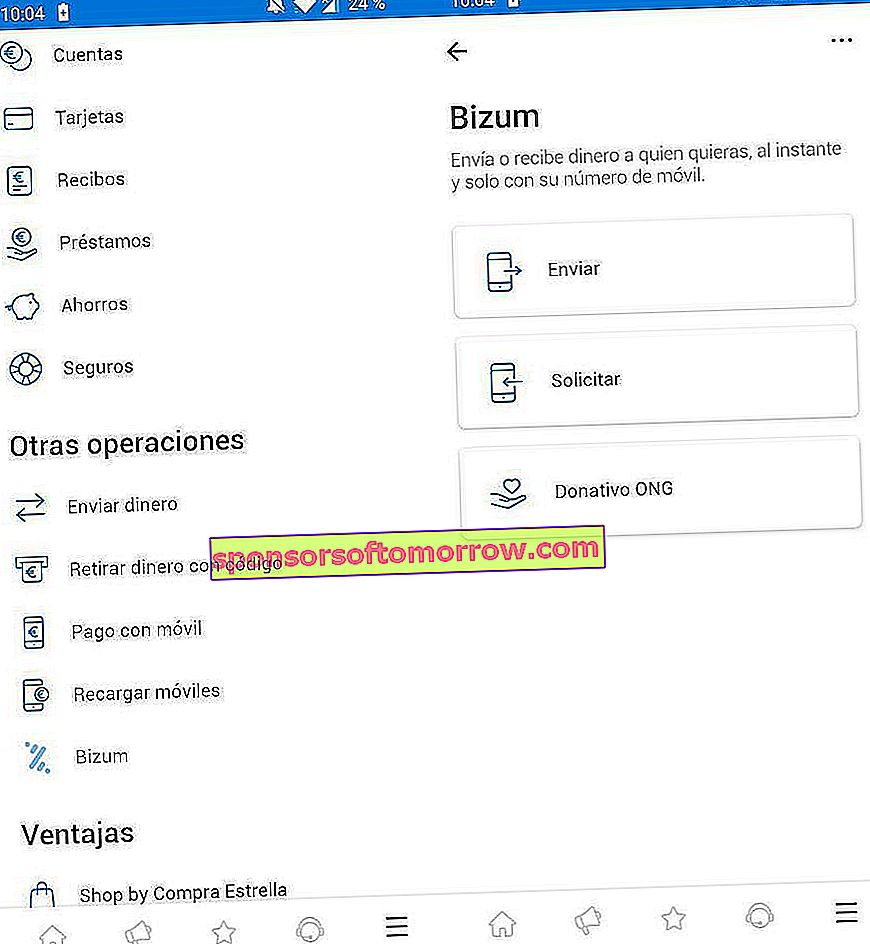

As we saw in the corresponding article, it is a solution developed by different entities in our country to standardize and streamline payments between individuals and small businesses, in such a way that operations (payment of services, money transfers ...) are performed immediately regardless of the entity from which it comes .

This is what Bizum looks like in the ImaginBank application.

This solution integrates directly into banking applications, so we will not have to resort to a third-party application. It should be noted that payments through Bizum are accepted through codes provided by SMS. The method used to secure transactions is based on the banks' TLS system , that is, the conventional system of transactions between banks.

A solution very similar to Bizum is TWYP, ING Direct's virtual card service. Although it was originally born as an independent application to make payments and transfers immediately, today it has converged into a virtual card that we can use through services such as Apple Pay or Google Pay through NFC technology .

Despite its conversion, the application continues to support instant money transfers between individuals and TWYP clients . The biggest difference with Bizum is that it does not integrate with third-party banking applications, as it is an ING Direct service. In other words, we will have to download the homonymous application on our mobile. The advantage of TWYP is that we can withdraw cash from the phone at various points compatible with the service, such as Dia, Clarel, Galp, ONCE, Hipercor or El Corte Inglés Supermercados.

The next solution is Google Pay, an option that coexists with Samsung Pay and Apple Pay. Beyond the technical and aesthetic differences between each of the solutions, the operation is practically identical. In summary, these solutions allow us to register compatible debit and credit cards to make contactless payments afterwards through NFC technology.

This is what Samsung Pay looks like.

Perhaps the biggest difference between each of these services is the availability and compatibility of banking entities. Google Pay and Samsung Pay are the two options with the greatest support from banks in Spain , while Apple Pay is somewhat more limited.

The last popular solution in our country is BBVA Wallet. Despite the bombastic name, the truth is that it is nothing more than BBVA's mobile payment service outsourced in the form of an independent application . The unique functionality of this tool is to make mobile payments via NFC through registered BBVA cards. There are similar solutions such as CaixaBank Pay, from La Caixa, or ruralvía pay, from Caja Rural.

The functionality of all these is the same: separate the management of mobile payment from the general application of banks . Curiously, these same entities allow mobile payments from the main application, so we will not have to download them.

5 tools to pay for your mobile and forget about cash